Page 67 - CTI94_EN

P. 67

C

Why is the Next Generation Turning Away Internal Factors Another reason younger people

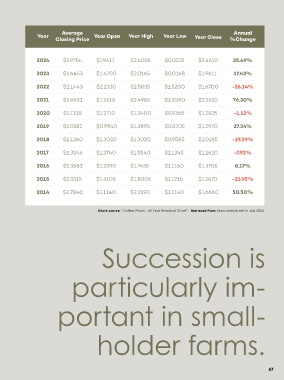

from the Farm? are leaving the coffee farm comes from inside the family. Year Average Year Open Year High Year Low Year Close Annual

Many parents want to protect their children from the Closing Price %Change

hardships they have experienced in life and coffee farm-

Brazil is the world’s largest coffee producer, fore-

ers are no different. Parents and grandparents know the

cast to produce 69.9 million 60kg bags of coffee in

high-risk, low-reward nature of coffee production and 2024 $1.9754 $1.9611 $2.6025 $0.0215 $2.4610 25.49%

2024/5. Like in other coffee-growing countries, most

want better lives for their children. Thus, they encourage

coffee farms in Brazil are smallholder farms, owned and

them to move to the city, get an education, and find a 2023 $1.6453 $1.6700 $2.0165 $0.0168 $1.9611 17.43%

operated by a single family. Succession is particularly

steady, respectful job. Ensuring a better life for future

important in smallholder farms, and not only for the

generations is a top priority, even if it means putting an

continuation of the family’s business. Coffee production 2022 $2.1443 $2.2330 $2.5835 $1.5200 $1.6700 -26.14%

end to the family business.

is a craft, and with the declining interest of younger

The uneven distribution of wealth is a significant point

farmers, we are at risk of losing the knowledge and skills 2021 $1.6933 $1.2615 $2.4985 $1.2090 $2.2610 76.30%

of concern. Coffee production lacks stability, and more

gathered by previous generations.

often than not, the farmers take all the risk on themselves.

But how could coffee production face such a crisis when 2020 $1.1138 $1.2710 $1.3400 $0.9365 $1.2825 -1.12%

With so many players within the distribution chain, pro-

consumption is booming? Unfortunately, there are multiple

ducers make as low as 0.10% of the end product’s price.

answers to this question. 2019 $1.0182 $0.9950 $1.3895 $0.8705 $1.2970 27.34%

Sometimes, this does not even cover the farm’s expenses,

Income Instability The first and probably most

which is why 44% of small coffee farms worldwide have

important reason younger people are not attracted to 2018 $1.1360 $1.3020 $1.3020 $0.9585 $1.0185 -19.29%

earnings below the poverty line.

succeeding their family on the farm is linked to income

There is also a gap in knowledge of the business of

instability. As an agricultural product, the income from 2017 $1.3346 $1.3740 $1.5540 $1.1345 $1.2620 -7.92%

coffee. Expocacer’s Sandra Moraes explains: “Producers

coffee production depends heavily on yields. With many

are not aware of the broad range of opportunities in the

external factors at play, the yield of a coffee farm may be

family business and have a limited view of coffee growing, 2016 $1.3683 $1.2390 $1.7435 $1.1160 $1.3705 8.17%

inconsistent. This leaves coffee farmers with a constant

usually restricted to the reality of the farm and not the

level of uncertainty about whether they will be able to

business as a whole.” Focused strictly on growing coffee, 2015 $1.3315 $1.6105 $1.8005 $1.1215 $1.2670 -23.95%

sustain and provide for their families.

older generations were never exposed to the rest of the

The coffee plant is considerably delicate, requiring

distribution chain, sometimes not even knowing how 2014 $1.7840 $1.1140 $2.2190 $1.1140 $1.6660 50.50%

very specific weather and ground conditions to generate

much their coffee is actually worth. To put this in per-

quality beans. Outbreaks of diseases such as Coffee Leaf

spective, in 2023 a farmer was paid an average of $3.63

Rust are unpredictable and can affect an entire farm. This

for 1kg of coffee. On the other end of the equation, a 12oz Chart source: “Coffee Prices - 45 Year Historical Chart”. Retrieved from: Macrotrends.net in July 2024.

hurts the farm’s ability to produce sufficient amounts of

bag of roasted specialty coffee sold for around $22. That’s

coffee, damaging its income potential.

a difference of more than 1,300%.

Shifts in weather conditions can hurt producers’ bot-

The distance between the coffee farm and the rest of

tom line too. Temperature changes and natural disasters are

the market is a major driver in the exodus of young family

out of the farmers’ hands but can hurt an entire harvest.

members. “Many younger generations feel limited to pro-

Since most coffee-growing countries have just one harvest-

duction management and not to the strategic management

ing season per year, some farms may lose a whole year’s

of coffee farming, including negotiations and market op- Succession is

income due to severe weather events.

portunities,” Moraes adds.

The market also plays a role in destabilizing farmers’

income as the price of coffee fluctuates regularly. Accord-

ing to MacroTrends, the year-close price for a kg of

coffee dropped from $4.98 in 2021 to $3.68 in 2022. In particularly im-

this case, a smallholder farm producing 500 bags of cof-

fee (60kg each) suffered a $39,000 blow to its revenue

between 2021 and 2022, all things equal. This is without

considering the increasing production costs like worker

wages, fertilizer, processing, and more (currently, year- portant in small-

close price in 2024 is $5.74/kg).

holder farms.

66 67